One for the History Books…

First Quarter 2021

In 2020, COVID-19 caused massive shifts in the capital markets:

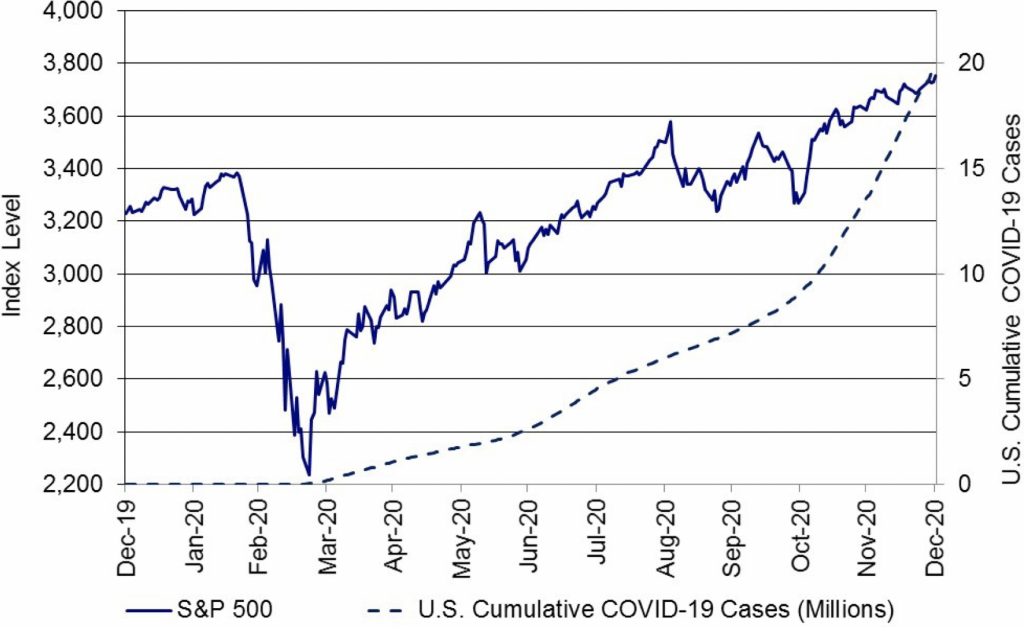

- The U.S. stock market experienced one of the most extreme roller coaster rides in history, with the S&P 500 index crashing 35% in the first quarter only to end the year up 18.4% from 2019.

- The performance divergence between growth and value stocks was the largest we’ve ever seen (even larger than any year during the tech bubble in the late 1990s).

- Bond markets experienced a similar, though less extreme drawdown, before sharply reversing and stabilizing at far lower yield levels than 2019.

- Non-U.S. stock and bond markets reacted in the same way throughout the year.

The uncoordinated yet similar monetary and fiscal response from governments and central banks around the globe were the driver behind both the stabilization and the subsequent rallying of these markets.

To provide some perspective of the magnitude of government stimulus efforts, according to the International Monetary Fund, during the 2008-2009 Great Recession, governments worldwide provided fiscal support amounting to 2% of global GDP. In 2020, fiscal support in reaction to the pandemic is estimated to be 12% of global GDP. This truly was a case of governments and central banks riding to the rescue, as economies around the world ground to a veritable halt and their populations feared for their personal health and worried about their financial health.

At the end of last year, global equity markets looked beyond the pandemic and priced in future growth, rather than the current economic environment, approaching winter, and rising infection rates. Indeed, there are reasons for optimism. Successful vaccines in the U.S. from Pfizer and Moderna rolled off production lines and into initial distribution in December.

As a result, the S&P 500 index ended 2020 at an all-time high, despite no indication that the spread of COVID-19 was under control or even slowing.

A second U.S. Government stimulus package, passed at the end of 2020, should help cushion many Americans from additional financial hardships due to the latest wave of COVID-19 shutdowns. A new administration (and a dovish Treasury Secretary) will take over the White House and will propose significant increases in government spending. While there is some concern that additional fiscal support and spending may be inflationary, we believe any inflation will most likely be a short-term phenomenon due to a potential surge in demand next spring and summer from consumers who have had their lives constrained for a year.

We understand that 2020 was challenging; please know that we are here for you. The new year brings a new administration, the promise and potential of a vaccine, and markets flirting with all-time highs. Do not hesitate to reach out to us to review your investment goals, your asset allocation, and your account(s).

– Mitchell Sinkler & Starr

—–

Two final notes:

At the end of this Commentary is our inaugural Investment Insights column. This quarter we explain and discuss our Fiduciary Duty as a Registered Investment Advisor. We hope to provide additional thought-provoking columns for our clients and friends each quarter going forward.

Separately, while video conference calls have become an important tool in the way we communicate with clients, they are not a substitute for in-person meetings. We enjoy sitting down with our clients and sharing stories over a cup of coffee or tea when we review their accounts. And while we hope a global vaccine will make travel an option soon, we will remain cautious and will only begin to visit clients when we are confident that we can do so safely, for everyone’s sake.

Economic and Capital Markets Data

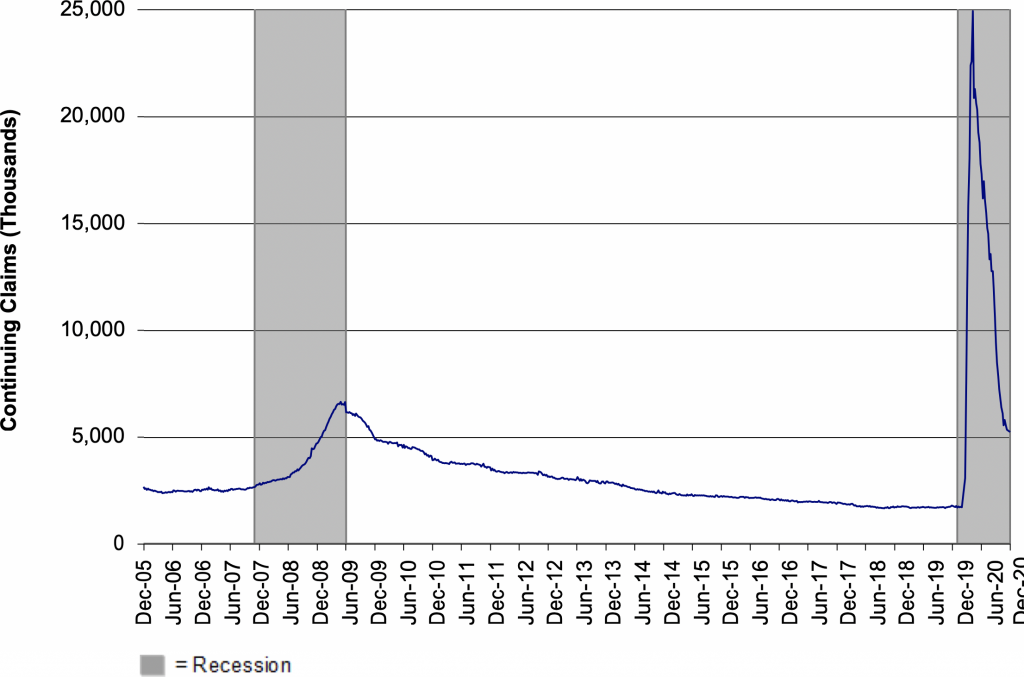

U.S. Continuing Jobless Claims – Fifteen Years

Continuing claims are now below the 2009 peak experienced during the Great Recession. Further improvement may not occur until the spring, depending on the roll-out of the vaccine.

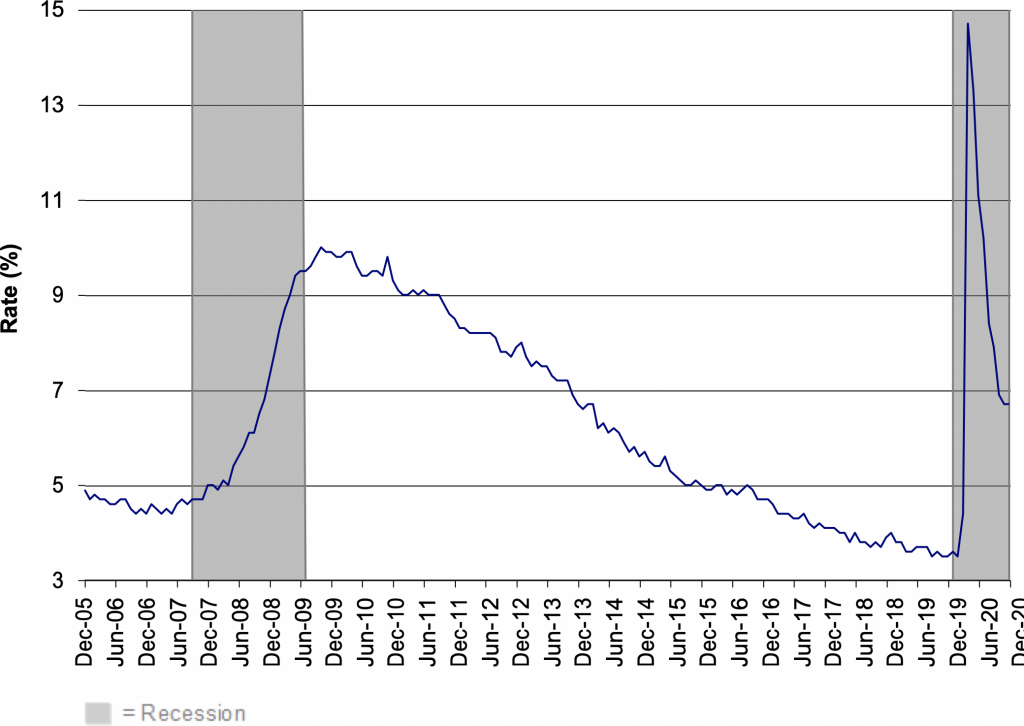

U.S. Unemployment Rate – Fifteen Year

While the decline in the unemployment rate looks promising, the rate of decline has slowed. More Americans are no longer being counted in the calculation as they have stopped looking for employment.

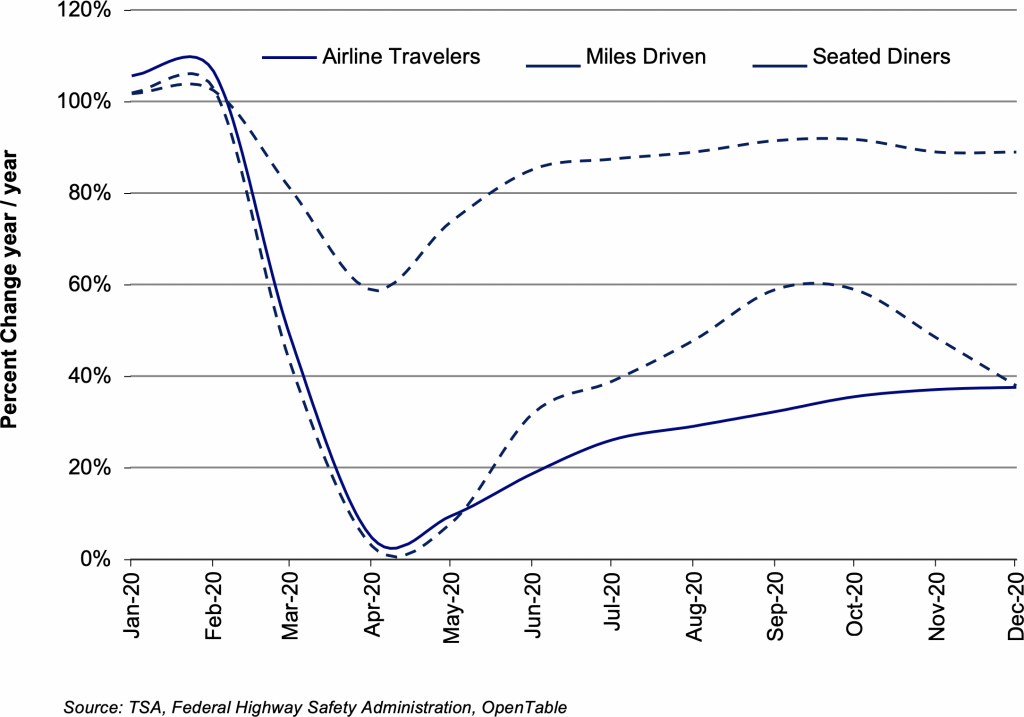

Alternative Data Points – 2020

After a strong summer recovery, alternative data sources now show flattening or declining economic activity coinciding with the current wave of the virus.

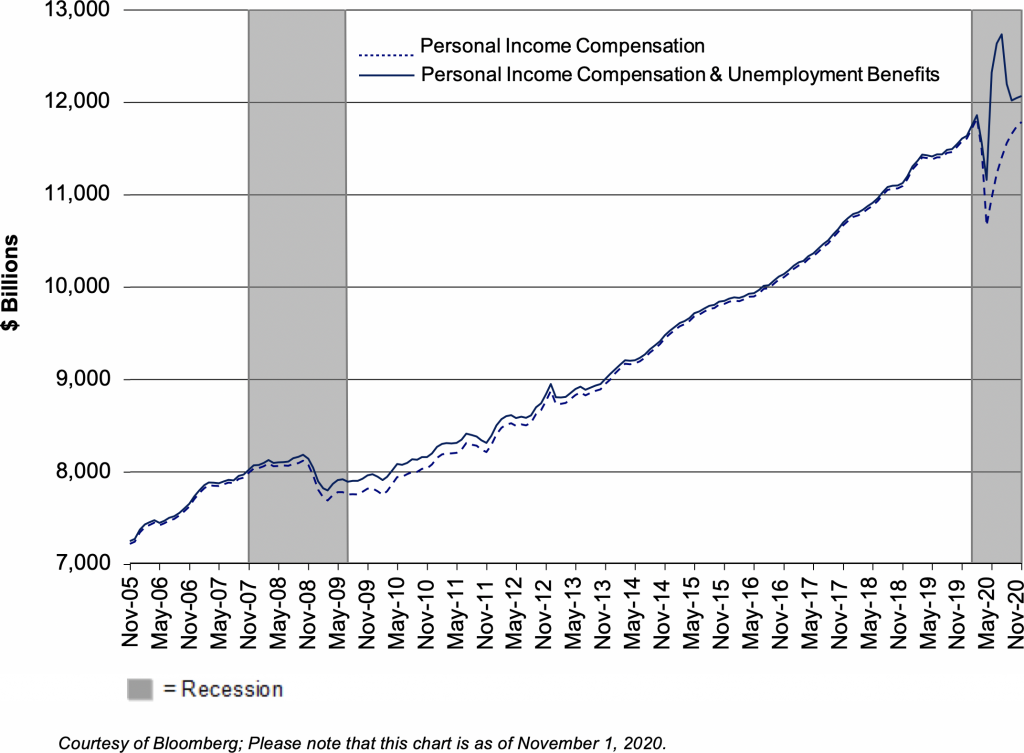

Total U.S. Monthly Compensation & Unemployment Benefits – Fifteen Years

Unlike previous downturns, Government unemployment and stimulus benefits were so significant in 2020 that they initially increased total employee compensation. While down from its peak, government assistance is still substantial on a historical basis.

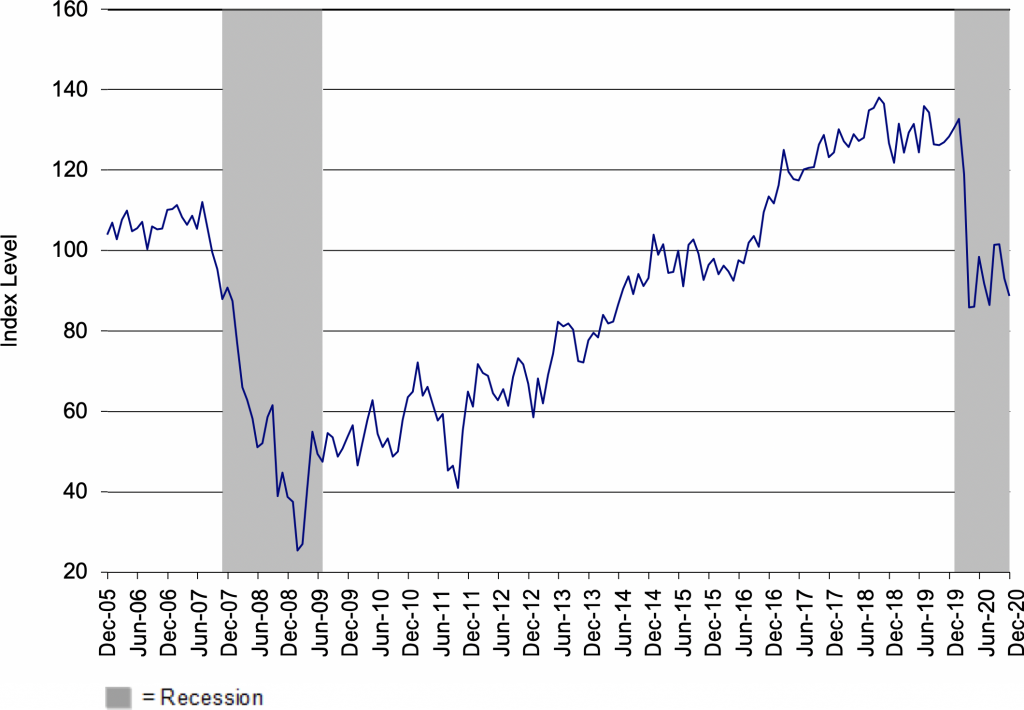

Consumer Confidence – Fifteen Years

Consumer confidence continues to be range-bound as waves of the virus ebb and flow. The vaccine roll-out has the potential to push confidence higher in 2021.

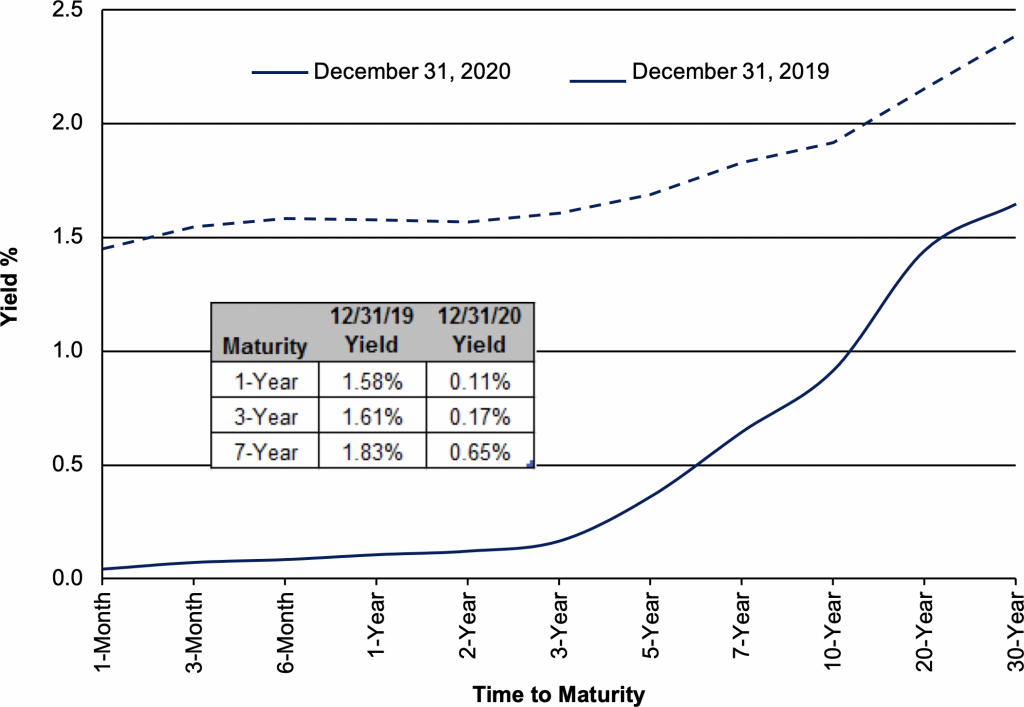

U.S. Treasury Yield Curve – Twelve Months

Consistent with the Federal Reserve’s intentional and massive intervention, interest rates, as shown on the Treasury yield curve, are still sharply lower than they were a year ago.

Standard & Poor’s 500 Index – Five Years

The U.S. stock market continued to grind higher in the fourth quarter of 2020, discounting mounting COVID-19 cases and a potentially difficult winter for many Americans. Predicated on widespread vaccination and a return to normal, it remains to be seen whether the market is ahead of itself.

Standard & Poor’s 500 Index – Sixty-Plus Years

Over the long-term, stocks remain the only liquid asset class with the potential for growth in excess of inflation.

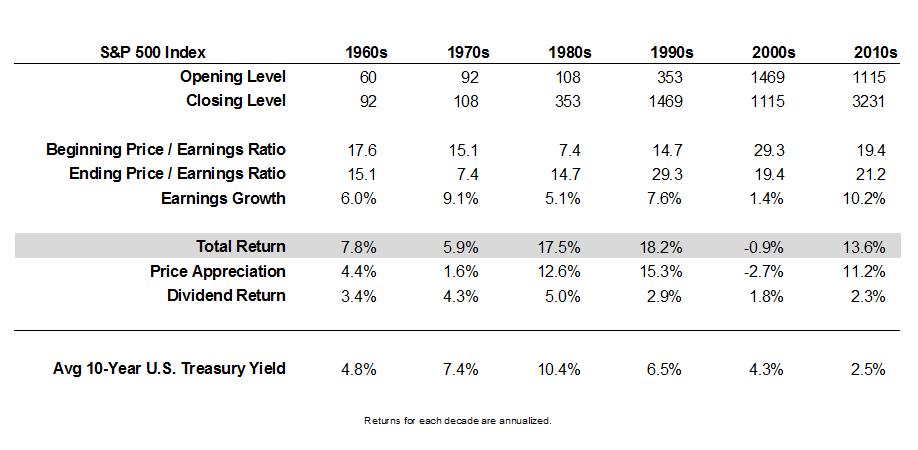

Financial Market Data – Decade-by-Decade

View entire commentary as a PDF

Investment Insights

Understanding the Concept of Fiduciary Duty

Key Points:

- A Registered Investment Advisor is required to serve clients’ best interests at all times and above all else.

- This fiduciary standard of care provides the highest level of legal protection.

- Mitchell Sinkler & Starr is held to this high standard, but not all investment professionals are.

Unless you live full-time in the world of financial services, you may sometimes feel that you need a translator to understand those of us who do. There’s no shortage of specialized terminology. Among the phrases you will often encounter, one that’s definitely worth knowing is “fiduciary duty.” It’s the key to understanding a major difference between investment firms that might at first glance seem the same. So what is a fiduciary duty?

In short, firms with a fiduciary duty are legally required to work in the best of interests of their clients, not their own.

Said another way, they cannot put their interests as a firm ahead of those of their customers. While it might seem this would be the foundation of any advisory relationship, there are, in fact, many instances in our industry when this is not the case.

A fiduciary relationship is generally considered to provide the highest standard of customer care under law. It requires full and fair disclosure of all fees, any conflicts of interest, and the material facts of any investment recommendation. As an SEC-Registered Investment Advisor, Mitchell Sinkler & Starr is required to meet this high standard.

On the other hand, in the eyes of the SEC, non-fiduciary advisers are essentially salespeople. They have no legal requirement to consider whether the investment products they recommend are in their clients’ best interest. Instead, many of these professionals are held to a so-called “suitability” standard: Is the advice they provide suitable for the client’s needs.

From a legal standpoint, this broad and open-ended suitability requirement rarely protects the investor.

For example, some advisers may only be licensed to sell certain insurance, annuity, and mutual fund products. These may be considered suitable, but result in high investment fees that are clearly not in the clients’ best interests. In addition, the adviser may be paid a commission on the sale of these products – a financial incentive creating an undeniable conflict of interest.

As an SEC-Registered Investment Advisor, Mitchell Sinkler & Starr is required to eliminate any such conflicts.

Furthermore, because our Firm is paid based on the market value of our client accounts, our interests fundamentally align. We prosper when you prosper.

Mitchell Sinkler & Starr’s philosophy and approach have always directly reflected our fiduciary duty. We are paid only by our clients and have no other sources of revenue, such as commissions. This way of doing business has benefitted the individuals, families, and organizations we serve for the past 50 years, and we fully expect it will continue to do so for the next 50.