Known Unknowns

First Quarter 2022

“There are known knowns… there are known unknowns… but there are also unknown unknowns.” – Donald Rumsfeld, former Secretary of Defense

If the last two years have taught investors anything, it’s that when it comes to investing there are almost zero known knowns, things we know with certainty. Known unknowns, on the other hand, are common – future company revenues and earnings, U.S. and global economic growth, central bank interest rate policies and investors reactions to them, to list a few. Some predict these known events correctly and some don’t (and no one gets them consistently correct).

It is the unknown unknowns — factors that we not only fail to understand but to even recognize as possible — that tend to violently disrupt economic conditions in ways no one could have possibly imagined.

COVID-19 is the perfect example. The ultimate unknown unknown, it completely dislocated global economies. As 2021 began, the vaccines created by Pfizer, Moderna, and Johnson & Johnson gave Americans, and indeed the world, hope that the COVID-19 nightmare would finally come to an end and the status quo would return. There seemed to be a light at the end of the pandemic tunnel.

During the first quarter of 2021, the U.S. stock market continued the rally that began in the initial depths of the crisis in March of 2020. Company earnings were stronger than expected as consumers began to spend record savings, while COVID hospitalizations declined rapidly as the elderly received vaccinations.

Consumer demand continued to skyrocket during the second quarter as the U.S. economy opened further nationwide. Inventories were drawn down and workers rehired, driving unemployment lower. The COVID Delta variant raged through India, but had not yet spread globally.

In the third quarter, the wheels of the COVID victory bus began to come off. Delta, more contagious than previous variants and just as dangerous, spread rapidly through the world, shutting down factories and ports and creating new lockdown headaches for local governments despite rising vaccinations rates. High consumer demand persisted, but supply was massively disrupted (see our Q4 Commentary), resulting in the first sustained high rate of inflation developed countries had seen in decades.

Despite all of this, companies continued to report strong earnings throughout the fourth quarter, driven by a consumer drawdown of accumulated government stimulus and personal savings. By the end of the year, earnings from companies in the S&P 500 Index had increased 44% on average over the prior twelve months and 20% from two years ago (pre-COVID). This explains the significant rise in the S&P 500 Index in 2021, even though when the year began, stocks were priced at earnings multiples not seen since the dot-com era.

2022 Outlook

Several factors – each of them “known unknowns” – have the potential to shape both economic growth and stock returns in 2022 (and beyond):

- Central Bank Actions – Front and center, the Federal Reserve has stated their intention to taper, or gradually end, their monthly bond-buying program. This intervention had been injecting $120 billion a month into the bond markets, pushing yields down and driving more investors into equities. This tapering is expected to be accompanied by an increase in short-term interest rates. Both moves will be dependent on the continued strength of the economy and the rate of inflation. Across the pond, the European Central Bank is also set to begin tapering in 2022. The combined effect of two of the most influential central banks simultaneously withdrawing liquidity could have adverse effects on equity and credit markets. Typically, unless economies are experiencing substantial growth, higher interest rates have a somewhat dampening effect on stock price appreciation.

- Supply Chains & Inflation – Inflation caused by several issues, including broken supply chains, was one of the headline stories of 2021. History, however, has shown that supply shortages are frequently followed by supply gluts. Expectations that current demand is sustainable may result in overproduction and restocked inventories that overshoot their mark—in short, a reversal of the situation that has fueled recent inflation. On the employment side, labor shortages have recently driven wages higher. Combined with an end to government pandemic assistance, this may lead to a sizeable rush of labor back into a market that may not be prepared or need it if demand begins to wane. This potential oversupply of workers could possibly lead to lower wages. So, while inflation may stay ‘higher for longer’ as many expect, there is a chance that inflationary pressure may begin to reverse depending on how supply chains and labor markets react to both the virus and economic growth in the first half of 2022.

- Chinese Real Estate – The situation in China (involving slowing real estate activity and frighteningly leveraged developers) has not been resolved and has spread to smaller property developers. Our primary concern, as mentioned in the prior Commentary, is the potential ripple effect on the Chinese financial sector and consumer spending, both of which have played important roles in global economic growth over the past decade. We continue to believe that the likelihood of this potential problem spreading beyond Chinese banks is low, but will watch for any impact on investor sentiment and the willingness to take risk (often referred to as “risk off” when stock prices decline) if it does occur.

- COVID Variants – The Omicron variant has spread quickly around the world and is by all accounts more contagious but far less lethal than Delta and other strains. We know there will be more variants to come. The risk is one that is both more contagious and more virulent. What that variant might look like, the ability of current vaccines to counter it, and its side effects are impossible to predict.

While these factors appear to present headwinds to the global economy, investors should not forget that the economic growth over the past 18 months has been led by strong consumer demand, which has resulted in higher earnings from companies across all industries, and by a banking system that is in far better shape than it was during the last financial crisis. In 2022, companies are expected to continue to restock their depleted inventories while consumer demand for goods and services should remain strong—positive signs, barring, of course, the impacts of all-new unknown unknowns.

A final note: Mitchell Sinkler & Starr would like to acknowledge the contributions of Mary Lou Blatteau, who retired on December 31, 2021. For 26 years, Mary Lou served in a variety of roles for the Firm. We will miss her hard work, authenticity, and humor.

– Mitchell Sinkler & Starr’s Portfolio Managers

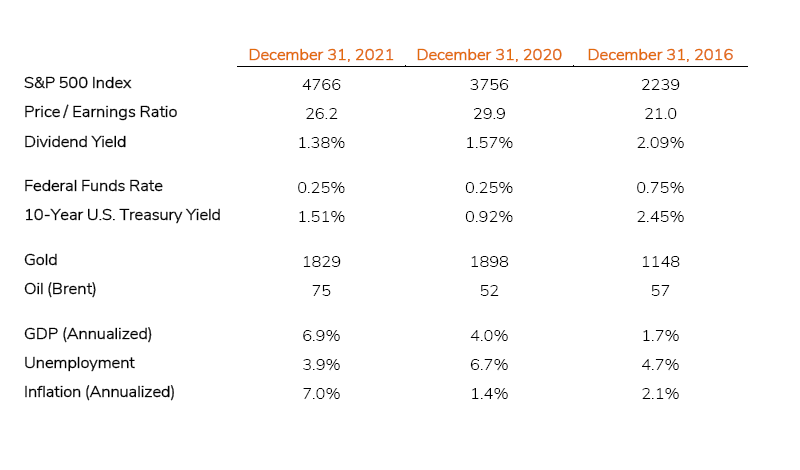

Economic and Capital Markets Data

Quarterly Charts

A brief selection of quarterly charts offering insights relevant to the current period.

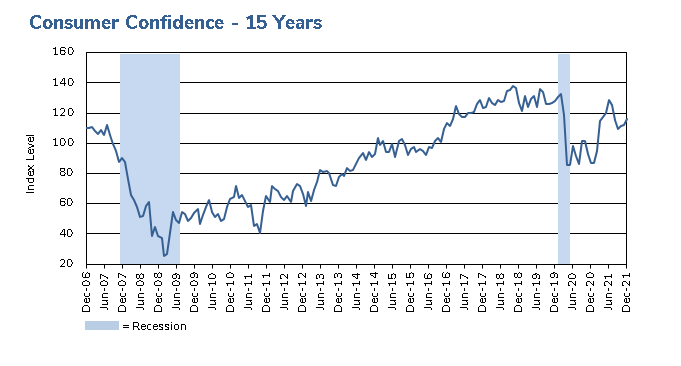

Consumer Confidence – Fifteen Years

After recovering from initial 2020 lows, consumer confidence took a hit from the Delta variant. However, confidence remained high heading into the new year.

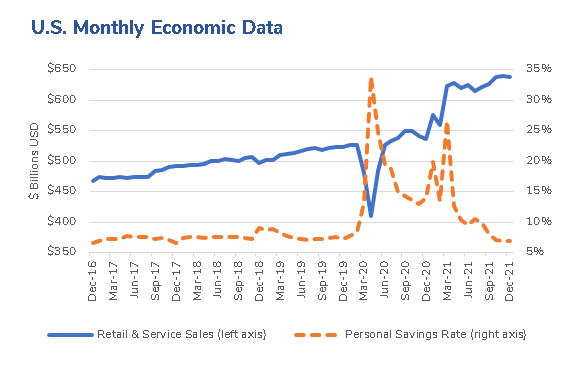

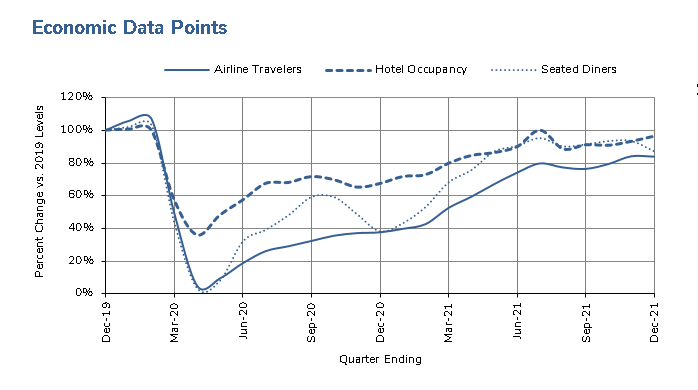

Economic Data Points

Several dynamics may have led to higher hotel occupancy rates at the end of 2021 (relatives visiting for holidays but staying in hotels, for example). However, the new Omicron variant may continue to shift this data as the first quarter of 2022 progresses.

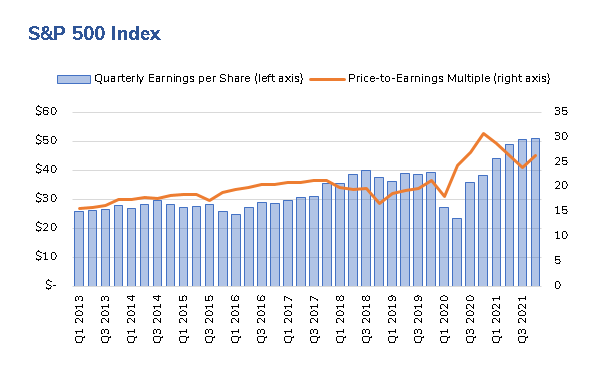

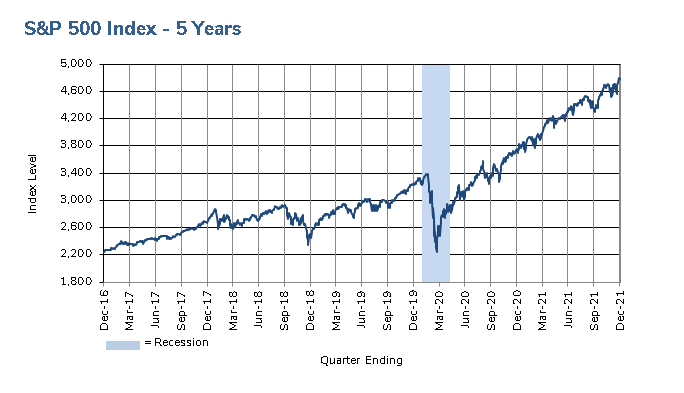

S&P 500 Index – Five Years

After concern at the end of the third quarter that the Delta variant would cause trouble for the economy, October earnings rolled in as strong as the prior two quarters. This alleviated fears of a slowdown in growth and propelled the S&P 500 Index to new highs in the fourth quarter.

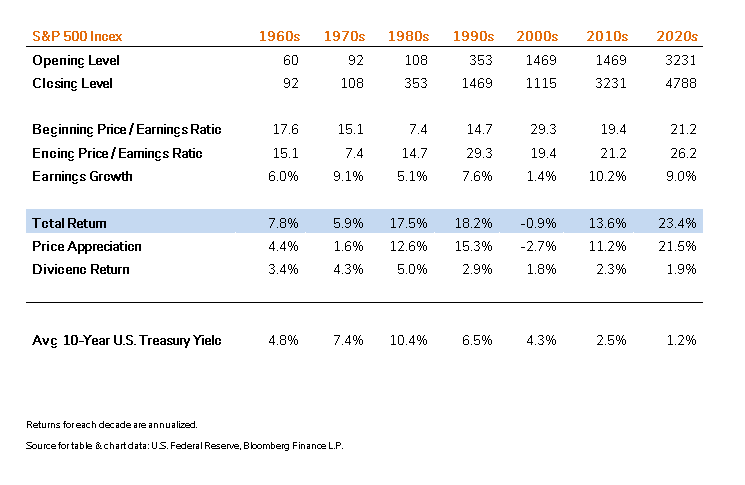

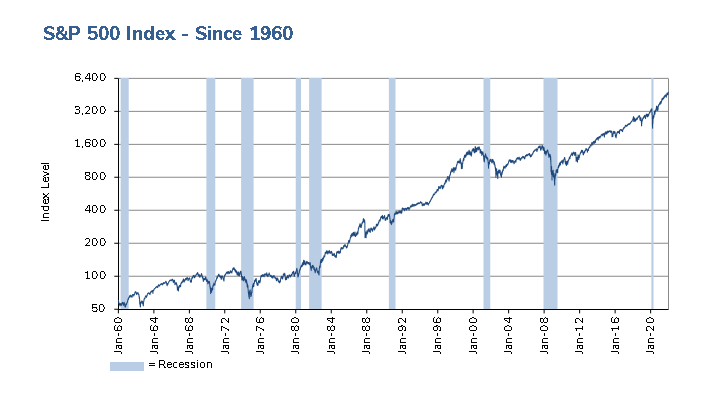

S&P 500 Index – Since 1960

Over the longer term, and especially in a low interest rate environment, we believe stocks remain the only liquid asset class with potential for growth in excess of inflation.

Over the longer term, and especially in a low interest rate environment, we believe stocks remain the only liquid asset class with potential for growth in excess of inflation.

Decade-by-Decade Market Returns